IRS Releases Proposed Regulations on ACA Reporting

December 13, 2021

Winter Action Plan to Battle COVID-19

December 13, 2021On November 23, 2021, the Office of Personnel Management and the Departments of Labor, the Treasury, and Health and Human Services (collectively, “the Departments”) published interim final regulations under the Consolidated Appropriations Act, 2021 (“CAA”) that require group health plans to submit an annual report to the federal government on prescription drugs and health care spending. The reports for calendar years 2020 and 2021 are due on December 27, 2022, and the reports for subsequent calendar years are due on the following June 1.

The annual reporting requirement generally applies to all group health plans. It does not apply to excepted benefit plans, short term limited duration insurance, and health reimbursement arrangements and certain other account-based plans.

Fully insured group health plans can transfer the reporting obligation to the insurance carrier by entering into a written agreement that obligates the carrier to perform the reporting function. The carrier will then be liable for any reporting violation.

A self-funded group health plan can also enter into a written agreement with a third-party administrator (“TPA”), or a pharmacy benefit manager (“PBM”) or other third party, to fulfill the reporting function, but the plan remains liable for any reporting violation.

According to the interim final regulations, the following information must be included in the annual report filed with the federal government:

• Total healthcare spending, broken down by type of cost (hospital care, primary care, specialty care, prescription drugs, and other medical costs, including wellness services)

• The 50 most frequently dispensed name-brand prescription drugs

• The 50 prescription drugs that generated the highest total annual spending

• The 50 prescription drugs with the greatest increase in total annual spending compared to the previous calendar year

• Prescription drug rebates, fees and other remuneration paid by drug manufacturers to the plan in each therapeutic class of drugs, as well as

for each of the 25 drugs that generated the highest rebate amounts

• The impact of prescription drug rebates, fees and other remuneration on premiums and out-of-pocket costs

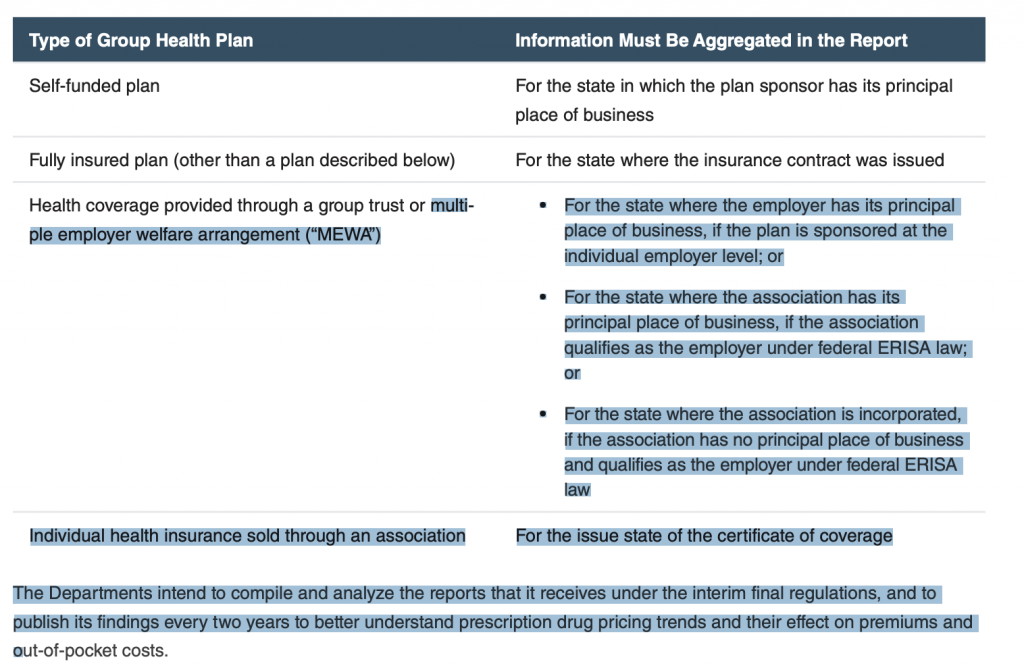

The interim final regulations contain standards and definitions that, for example, identify prescription drugs on a uniform basis regardless of dosage strength, package size, or mode of delivery. Information in the report must be aggregated separately for each state in which coverage was provided under the plan, except as set forth in the following chart:

Employer Action

While the deadline for calendar year 2020 and 2021 reporting is a year out (December 27, 2022), employers should start discussing next steps with brokers, carriers, TPAs and PBMs.

Fully insured plans. Employers should enter into written agreements with their insurance carriers and HMOs to transfer the reporting obligation and liability to the carrier.

Self-funded plans. Employers should enter into written agreements with TPAs, PBMs, or other third parties to ensure the vendor will provide the required reporting to the Departments. As the self-funded plan remains liable for reporting, employers should monitor the reporting efforts of the TPA or other third party to help minimize the exposure to liability for any reporting violation.