Court Vacates Drug Manufacturer Coupon Cost-Sharing Rule

November 7, 2023

2024 Cost of Living Adjustments

December 12, 2023On October 18, 2023, the IRS released Notice 2023-70, announcing that the adjusted applicable dollar amount used to

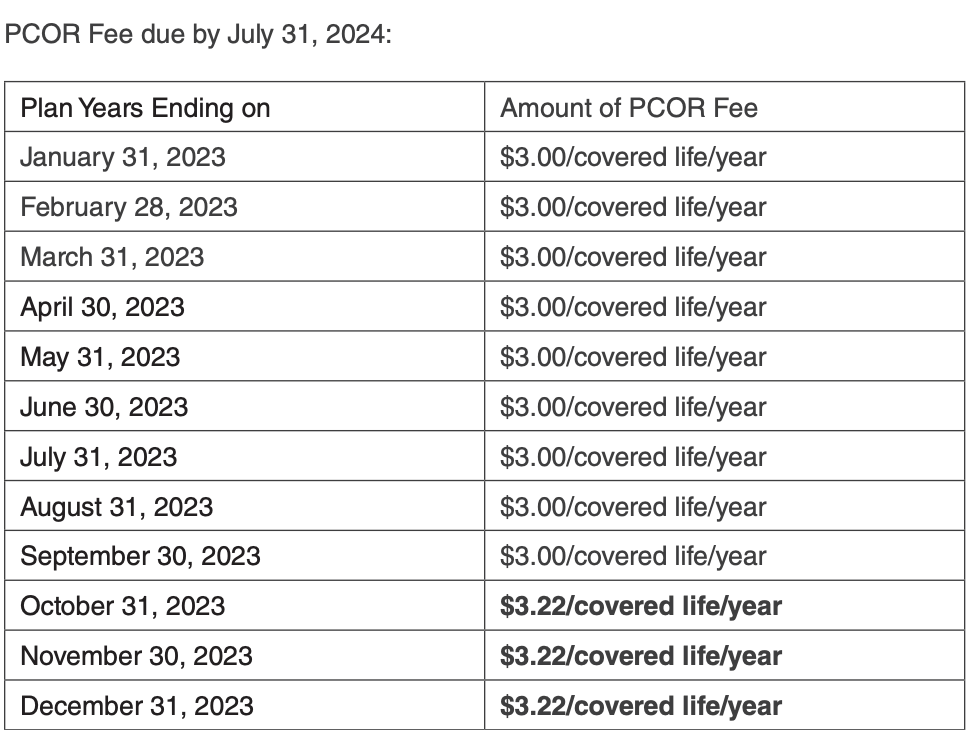

determine the PCOR fee for plan years ending on or after October 1, 2023, and before October 1, 2024, is $3.22.

The PCOR filing deadline is July 31, 2024, for all self-funded medical plans (including level-funded) and some HRAs for plan years (including short plan years) ending in 2023. Carriers are responsible for paying the fee for insured policies.

PCOR Fee due by July 31, 2024:

Employer Action

For now, no action by employers with self-funded health plans (or an HRA) is required. We will send a reminder in mid-2024 of the fee and additional information for filing and paying the PCOR fee with the IRS.

It should be noted that we have seen increased enforcement activity from the IRS around missing PCOR fees. Specifically, the IRS is issuing CP161 notices to employers who appear to have missed a prior year PCOR fee filing, requesting payment (including interest and penalties).