New PCOR Fee Announced

December 23, 2024

FAQ 68 Addresses Preventive Care and Mastectomy Coverage

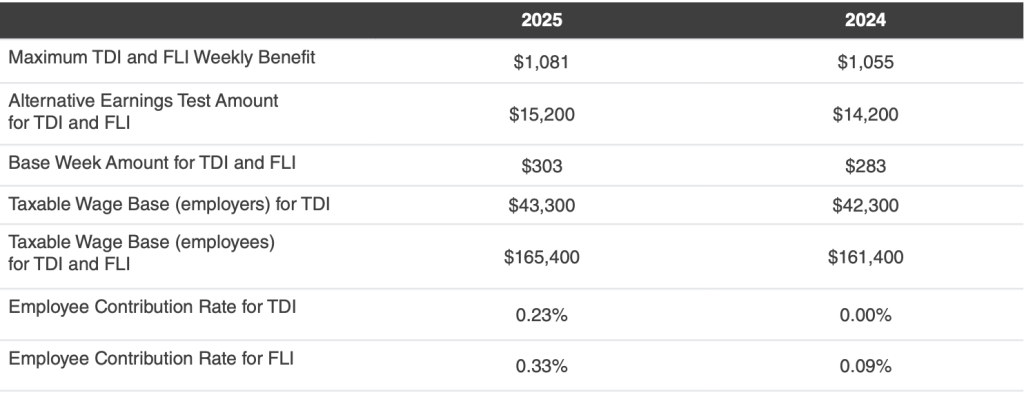

December 23, 2024New Jersey has announced the 2025 contribution rates and benefit level parameters for the Temporary Disability Insurance (“TDI”) and Family Leave Insurance (“FLI”) programs. Compared to 2024, the 2025 rates and benefit parameters are as follows:

Temporary Disability Insurance 2025

TDI provides benefits to eligible New Jersey workers for non-job-related illness, injury, or other disability that prevents them from working or due to certain public health emergency reasons. To be eligible for TDI, employees must have worked 20 weeks earning at least $303 per week (“Base Week Amount”) or have earned a combined total of $15,200 (“Alternative Earnings Test”) in the four quarters (“base year”) prior to taking leave. Following a 7-day waiting period (except for certain public health emergencies), the weekly TDI benefit is 85% of an employee’s average weekly wage but no greater than $1,081. TDI may be payable for up to 26 weeks in a 52-week period.

Employees typically contribute to TDI; however, in 2023 and 2024, employee contributions were reduced to zero. For 2025, employee contributions have been set at 0.23% of wages. The maximum contribution for 2025 is 0.23% up to the Taxable Wage Base (Employee) of $165,400 equal to $380.42.

Family Leave Insurance 2025

Family Leave Insurance provides benefits to eligible New Jersey workers for (i) the first 12 months following the birth,

adoption or foster care placement of a child, or (ii) to care for a seriously ill family member. Similar to TDI, to be eligible

for FLI employees must have worked 20 weeks earning at least $303 per week (“Base Week Amount”) or have earned a

combined total of $15,200 (“Alternative Earnings Test”) in the four quarters (“base year”) prior to taking leave. The weekly

FLI benefit is 85% of an employee’s average weekly wage but no greater than $1,081. FLI may be payable for 12 consecutive weeks in a 12-month period, or up to 8 weeks (56 individual days) in a 12-month period, if taking leave intermittently.

Employees contribute 0.33% of wages up to the 2025 Taxable Wage Base (Employee) of $165,400 equal to $545.82

($145.26 in 2024).