HHS Extends Public Health Emergency

July 29, 2022

New Prescription DrugReporting Requirement

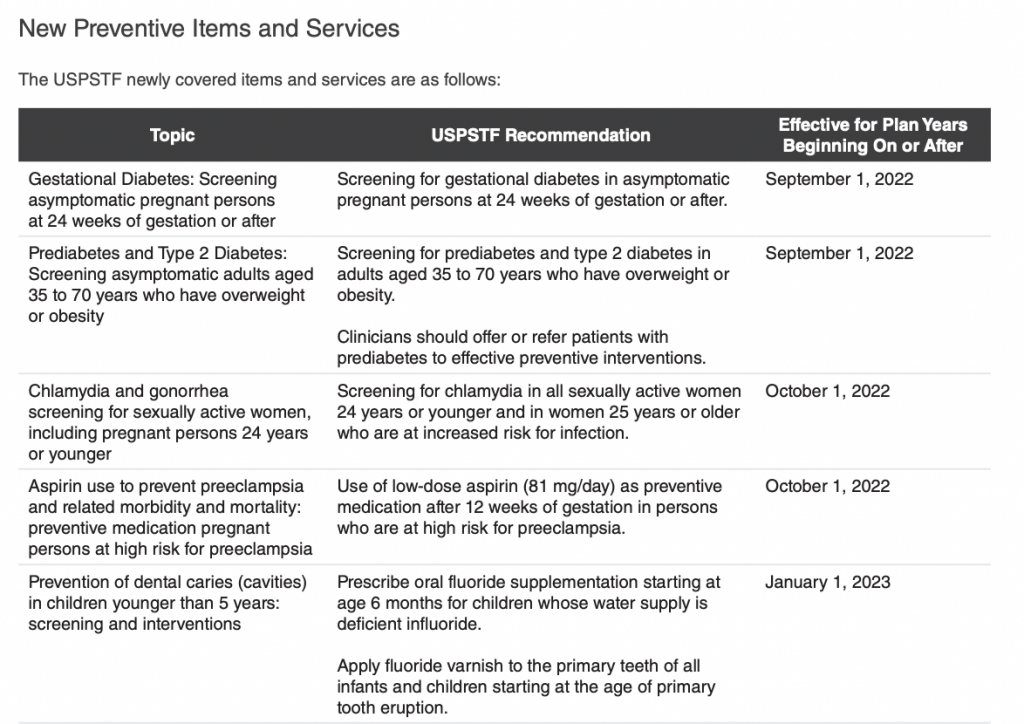

August 8, 2022Most plans will be required to cover new preventive items and services beginning later this year or in 2023 (depending

on the plan year), including ones related to condoms, double-electric breast pumps, suicide risk screening for adolescents, and diabetes screenings for certain populations.

Background

Non-grandfathered group health plans must provide coverage for in-network preventive items and services and may not impose any cost-sharing requirements (such as a copayment, coinsurance, or deductible) with respect to those items or services. Evidence-based items or services that have in effect a rating of A or B in the current recommendations of the United States Preventive Services Task Force (“USPSTF”) are considered to be “preventive.” The USPSTF recommendations can change, and those changes generally apply for plan years that begin on or after the date that is one year after the date the new recommendation or guideline is considered to be issued. Additionally, the Health Resources and Services Administration (“HRSA”) has updated preventive care and screening guidelines for women and for infants, children, and adolescents.

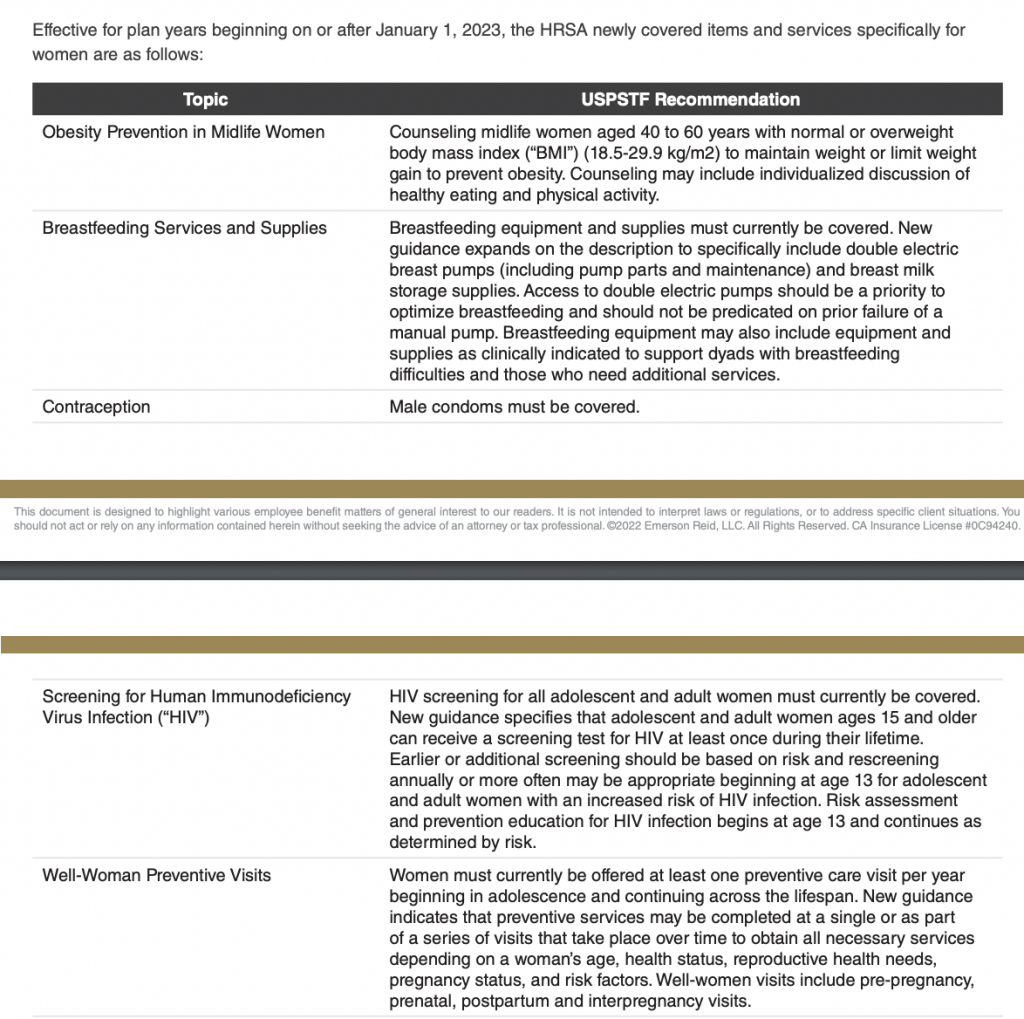

Effective for plan years beginning on or after January 1, 2023, the HRSA newly covered items and services specifically

for children and adolescents are as follows:

• An assessment for risks for cardiac arrest or death in ages 11-21 years was added.

• An assessment for hepatitis B virus infection in newborn to 21-year olds was added.

• Screening for suicide risk for ages 12-21 to the current Depression Screening category was added

• Psychosocial/behavioral assessment coverage was expanded to behavioral/social/emotional screening

for newborn to 21-year olds.

• There is a clarifying reference to dental fluoride varnish and fluoride supplementation.

Employer Action

Employers sponsoring non-grandfathered group health plans should review the various preventive care requirements effective for their upcoming plan years. Such coverage must be provided in-network, without cost-sharing.

Fully insured health plans: Carriers are generally responsible for compliance and should include these benefits as applicable.

Self-funded health plans: Discuss with TPAs to ensure coverage is in effect for plan years that begin on or after the applicable effective dates.