July 1 Deadline Approaching forMachine-Readable Files

June 10, 2022

Mental Health Conditions Can Trigger FMLA

June 27, 2022

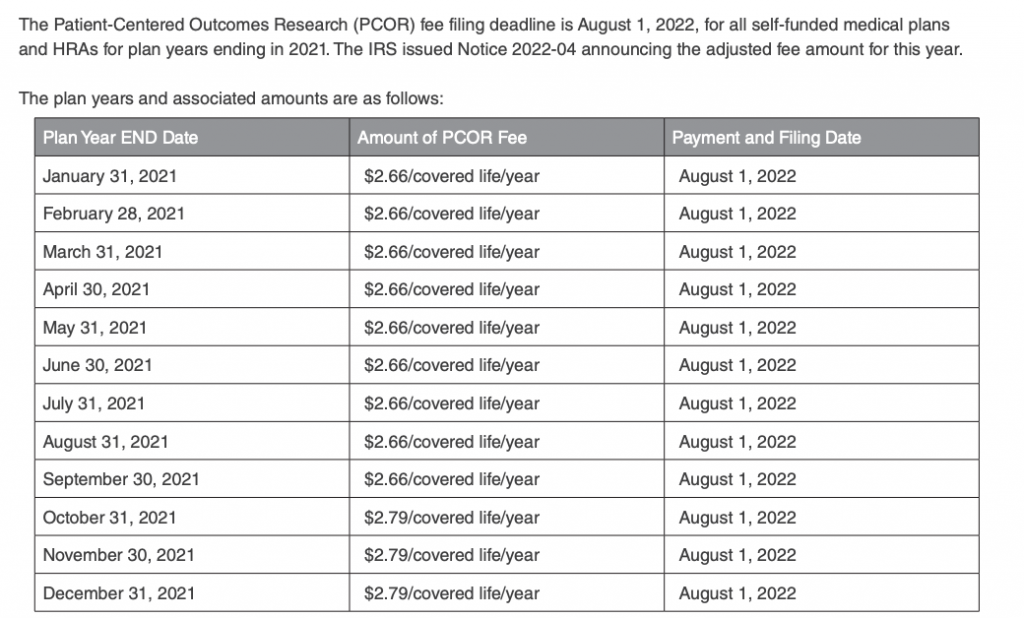

Employers with self-funded health plans ending in 2021 should use the 2nd quarter Form 720 to file and pay the PCOR fee by August 1, 2022. The information is reported in Part II.

Please note that Form 720 is a tax form (not an informational return form such as Form 5500). As such, the employer or an accountant would need to prepare it. Parties other than the plan sponsor, such as third-party administrators, cannot report or pay the fee.

For additional information, please visit the following IRS sites:

• Form 720, Quarterly Federal Excise Tax Return, instructions and forms: https://www.irs.gov/forms-pubs/aboutform-720.

• Patient-Centered Outcomes Research Trust Fund Fee, Questions and Answers: https://www.irs.gov/newsroom/

patient-centered-outcomes-research-institute-fee

• PCOR Filing Due Dates and Applicable Rates Chart: https://www.irs.gov/affordable-care-act/patient-centeredoutreach-research-institute-filing-due-dates-and-applicable-rates