New Philadelphia EmployeeCommuter Transit Benefit Programs

August 17, 2022

Inflation Reduction Act –Health Care Considerations

September 1, 2022Another compliance deadline is quickly approaching. For plan years that begin on or after January 1, 2023, group health plans must provide for advance disclosure of cost-sharing information to enrollees seeking health services, upon request and to the extent practicable.

The format of the disclosure is through an Internet-based self-service tool, telephone, or paper format (upon request).

The tool allows the enrollee to compare the amount of cost-sharing that he or she would be responsible for with respect to a discrete covered item or service by billing code or descriptive term. The required information relates to geographic region and in-network and out-of-network providers and initially addresses 500 items and services. Full compliance (all items and services) is required for plan years beginning on or after January 1, 2024.

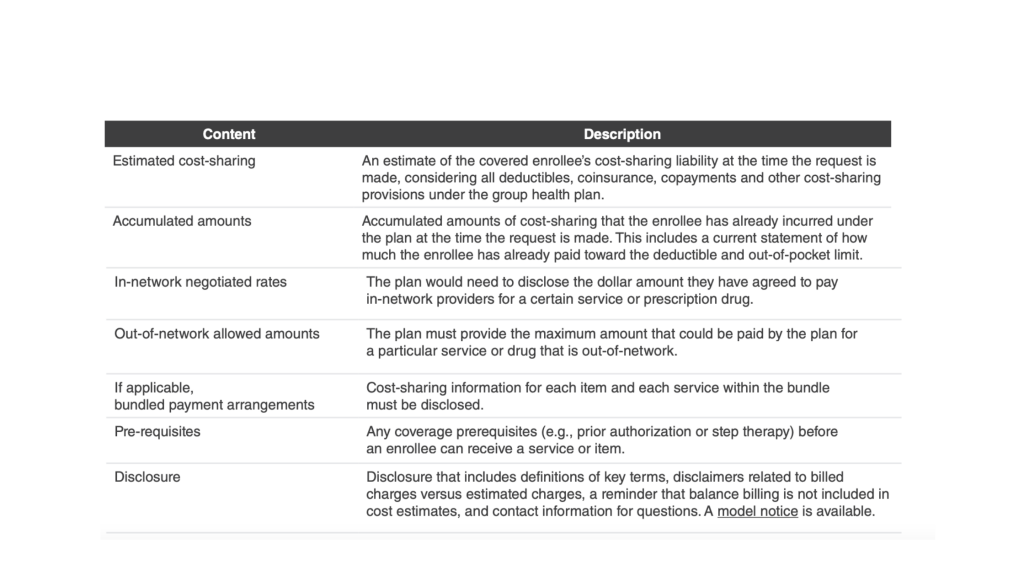

Specifically, the following cost-sharing information must be disclosed. The information should be accurate as of the time the request is made.

Good faith relief is available. When a plan or carrier makes an error or omission when acting in good faith and with reasonable diligence a plan will not fail to comply because:

• An error or omission in the required disclosure is made, provided the information is corrected as soon as practicable.

• The internet website is temporarily inaccessible, provided that the plan or carrier makes the information available as

soon as practicable.

• Information must be obtained from a third party to comply with this requirement, and is relied upon in good faith, unless it is known (or reasonably should have known) the information is incomplete or inaccurate.

Insurers are responsible for compliance with respect to insured plans. Employers with a fully insured plan can agree in writing to have the carrier provide the disclosure. If the carrier fails to comply, the carrier (and not the plan’s sponsor) is liable.

While employers are responsible for compliance with respect to self-funded plans, third party administrators are expected to handle this task on their behalf. Employers should seek written assurances of their assistance with this requirement.

Additional guidance may be issued before the effective date. We will continue to monitor developments.